Image credit: Unsplash

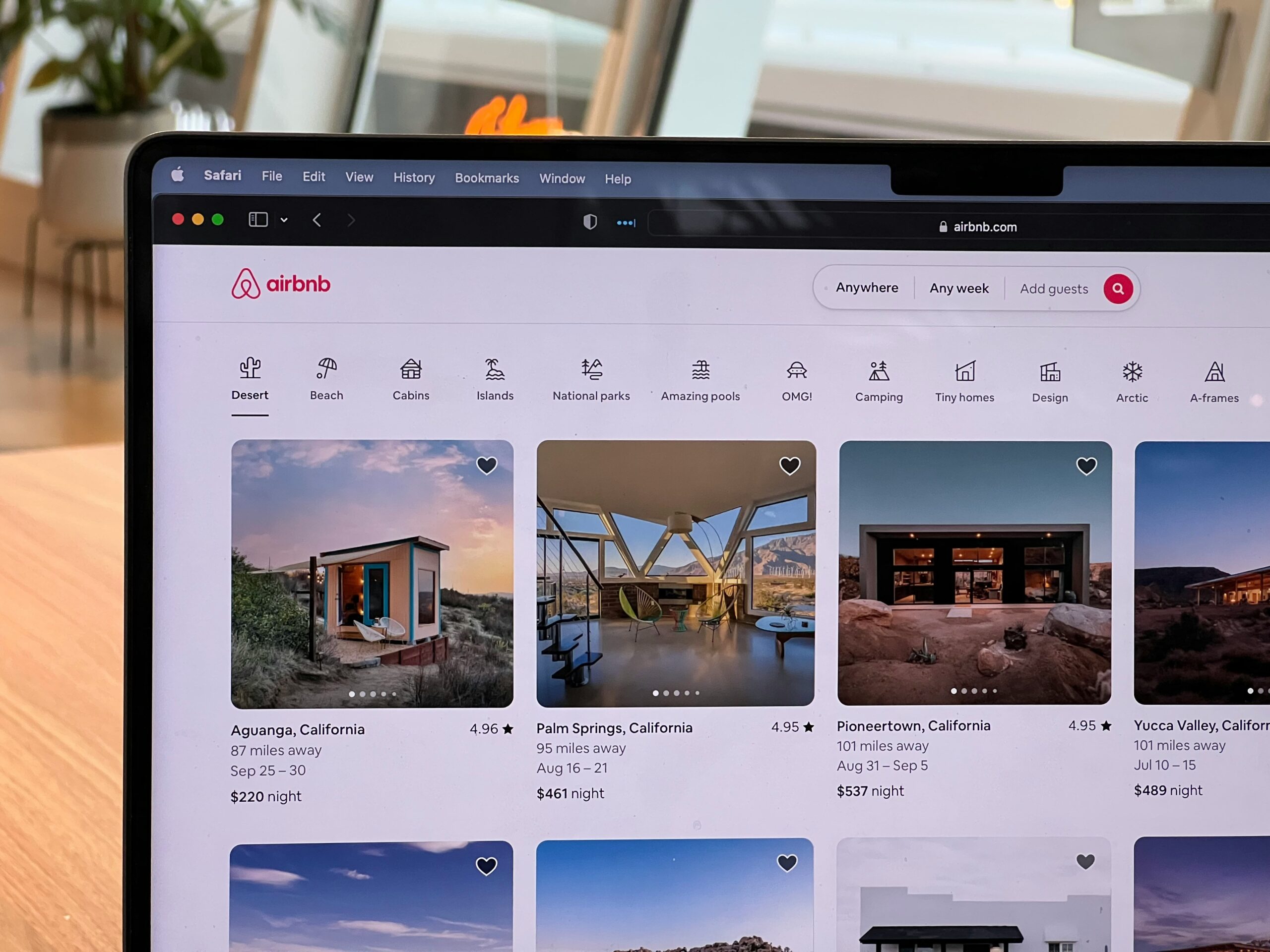

A noticeable trend is emerging in the Hamptons’ real estate market. Current homeowners, especially New Yorkers, are starting to reduce prices on their second homes, pointing towards the emergence of more ‘middle-class’ vacation homes in the region.

According to the New York Post, sellers in the Hamptons are adjusting to a new economic reality, with significant price drops on homes valued between $2 million and $5 million. Areas such as Sag Harbor and Amagansett are seeing reductions up to 20%. These reductions suggest a market adjusting to broader economic pressures, potentially opening the door to buyers who previously found the Hamptons beyond their financial reach.

The current financial environment, characterized by rising interest rates, drives these price reductions. Homeowners with variable-rate loans prepare for higher costs as introductory mortgage rates end. This situation has been worsened by the Federal Reserve’s decision to raise interest rates 11 times since March 2022, pushing mortgage rates to nearly 8%, a peak not seen in over twenty years.

These rising rates have a pronounced effect on those who took advantage of three- to five-year introductory rates during the pandemic. As these periods end, they are met with significantly higher monthly payments, prompting a reevaluation of their need for a second home.

Compounding this financial strain is the shift in work patterns. As New York workers return to their offices, the need for spacious homes to accommodate remote work in the Hamptons is decreasing. “Now that people are back at the office, they don’t need all that space for a ‘Zoom room,” a source told the Post. Consequently, many are converting their home offices into living spaces and placing their properties on the market.

The combination of increased interest rates and the end of widespread remote work is reshaping the real estate industry in the Hamptons. This adjustment creates opportunities for new buyers previously priced out of the market. What was once considered unattainable for many is now within a more achievable range.

This shift could introduce a more diverse group to the community, altering the region’s demographics. It might also benefit local businesses if these new ‘middle-class’ homeowners use their vacation homes throughout the year, providing a more consistent customer base.

Despite these changes, the Hamptons will likely retain its association with affluence and high-end vacationing. However, there is a slight opening up of the market to those who are not at the highest tier of wealth but who are still financially well-off.

It may be the best time for those considering a home in a coveted location. The market’s shift provides a new narrative: the Hamptons is becoming more accessible to individuals and families in the upper-middle-class bracket.

Observing how these changes play out in the long term for the Hamptons will be interesting as the market adjusts. The ‘middle-class’ vacation home may still be a relative term in such a luxurious setting. Still, the current market trends indicate a chance for a new group of homeowners to establish roots in this desirable locale. It is a unique moment that underscores the evolving real estate scenario and the broader economic landscape affecting vacation home ownership in one of America’s most prestigious coastal regions.