Image credit: Unsplash

In 1805, Emperor Napoleon faced the combined Russian and Austrian forces at the Battle of Austerlitz. Though outnumbered, he feigned weakness by abandoning a key position, luring the Allies into attacking. Once committed, Napoleon counterattacked their center, splitting their army and securing a decisive victory, cementing his reputation as a brilliant strategist.

Strategy is important on the battlefield and in the boardroom. Aspirant leaders in the field of institutional investment would do well to emulate Napoleon and apply proven approaches to major business or career moves. One of the best tried and true strategies is the implementation of sound investment habits. After all, as Sun Tzu wrote in ‘The Art of War’, “Opportunities multiply as they are seized.”

Juan C. Espinoza, a value investor with over 20 years of global investing experience selecting equity and credit securities, believes that intellectual curiosity, a knack for research, a passion for business and financial analysis are crucial in the high-pressure world of institutional investors. However, Espinoza believes that there are habits that the most successful institutional investors cultivate to keep them on the path to success, particularly during turbulent times.

Going the Extra Mile

According to Espinoza, investing on behalf of institutional clients demands strict adherence to carefully crafted investment mandates, extensive research and trading resources, and the necessary infrastructure to fulfill the fiduciary responsibilities required by sophisticated clients. But, Espinoza adds, “the most successful investors go several steps further and adopt certain behaviors that effectively limit their ability to make big mistakes or compound the impact of smaller mistakes already made.”

Espinoza calls these behaviors ‘Power Habits,’ as they are recurrent, methodical, and become an integral part of the investment process, much like more obvious aspects of investing, such as analysis and forecasting. More importantly, these powerful habits acknowledge that the human mind is subject to fears and biases, even among the most sophisticated professionals.

Espinoza’s Seven Habits framework provides a solid foundation for institutional investors to evaluate risk and reduce the impact of human error. However, Espinoza emphasizes that this doesn’t mean investors should act like robots. He states, “These seven habits are essential for any institutional investor aiming for long-term success and, with practice, their application becomes more instinctive rather than mechanic. In my over two decades of experience with top teams and industry leaders, I’ve seen that the most successful consistently practice some version of these habits, which help them turn challenges into great opportunities.”

The 7 Power Habits of Successful Investors

Recruit a sounding board. Every investor, especially those managing large sums, needs an impartial voice of reason. Having someone uninvolved in the investment process who can stay calm and objective is essential. This trusted voice may have to “talk you off the ledge” when irrational fears or overconfidence set in.

Accept that the truth may not be absolute. During market swings, different interpretations of the same events can shape market sentiment. For instance, a change in interest rates might signal either the potential for growth or economic weakness. Investors must accept that conflicting facts can coexist, and both positive and negative truths often emerge in uncertain times.

Study history and appreciate that cycles exist. Investors should learn from history’s lessons on how markets have responded to wars, revolutions, and economic crises. While rare “black swan” events can happen, most market crises have historical parallels. Understanding these prior events helps investors maintain perspective and avoid panic during turbulent times.

Ensure your personal life is in order. An investor’s judgment can suffer if personal issues arise during a market crisis. High debt balances, overspending, or neglecting basic health can impair decision-making. Stability in one’s personal life ensures better focus when bold, calculated actions are needed.

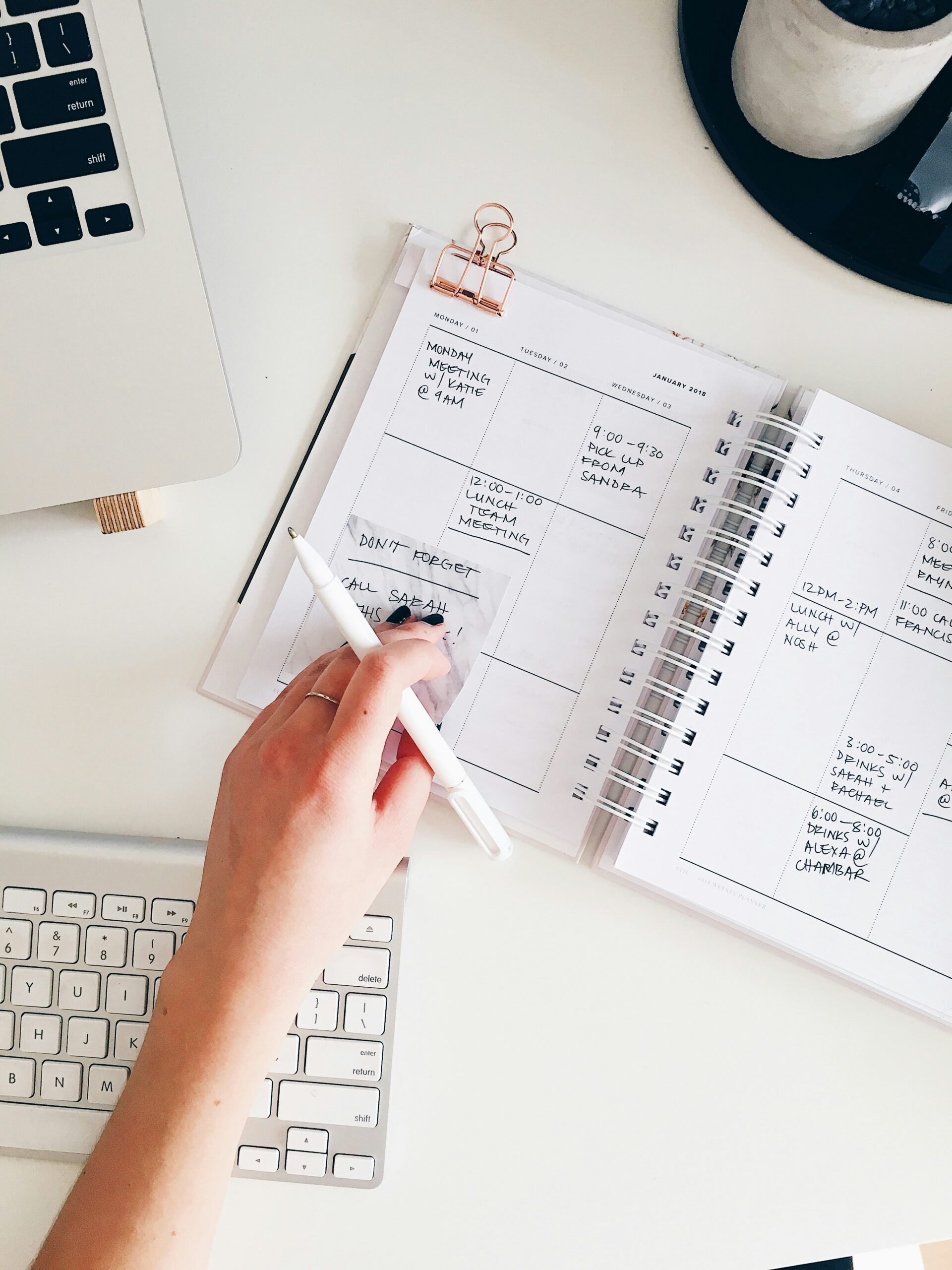

Always plan for the long term. Regardless of short- or long-term investment strategies, having a long-term vision is vital for business stability. Investors should always consider maintaining financial discipline in the business, having emergency funds available, and avoiding over-hiring to ensure their operations thrive through both good and bad times.

Prepare for opportunistic events. Crises often bring unique opportunities for growth. Whether it’s buying undervalued stocks, gaining new clients from competitors, or making opportunistic acquisitions, tough times allow savvy investors to go on the offensive when others are playing defense.

Practice meditation. Though it may seem cliché, meditation is one of the most valuable habits. It brings mental and physical health benefits and is particularly useful for those who need to think, strategize, and analyze large amounts of information. Meditation helps calm the mind and provides focus, especially during uncertain times. Experiment with different forms of meditation until you find one that fits your routine.

Espinoza considers these seven habits to be the essential for any institutional investor aiming for long-term success. With over two decades in the industry, working alongside world-class teams and some of the best minds, he confirms that the most successful investors consistently adhere to these foundational practices, enabling them to transform challenging times into opportunities for growth and success.

The institutional investment sector is much like a battlefield; success hinges not only on strategic foresight and tactical execution but also on the ability to adapt amidst chaos. In this arena, every decision counts, and only those who balance opportunism with emotional discipline will emerge victorious. By cultivating strong habits, as outlined by Espinoza, investors can navigate challenges more effectively and add significant value to their clients and careers.

To understand the key differences between outstanding institutional investors and their peers, and obtain valuable insights into the habits that empower professionals to thrive in the competitive landscape of institutional investment, visit Juan C Espinoza’s LinkedIn page.

Written in partnership with Tom White.