Image credit: Unsplash

In recent years, the fintech sector has witnessed a significant transformation with the emergence of Banking as a Service (BaaS). Swid, a cutting-edge fintech company, is at the forefront of this innovation, bringing a fresh approach to traditional banking methods. Their strategic approach in leveraging BaaS stands as a testament to their dedication to reshaping financial services.

BaaS has been a buzzword, promising robust solutions for financial institutions eager to forge new partnerships with brands that have a deep understanding of their customers across various sectors. This dynamic system has allowed banks to adapt to technological advancements, ensuring they remain relevant in a constantly evolving digital landscape.

For Swid, this isn’t just about hopping onto a trend. It’s about recognizing the potential of a revolutionary business model and integrating it to offer superior banking solutions. Partnerships are one of the cornerstones of Swid’s strategy. Instead of operating in isolation, they believe in the power of collaboration. By teaming up with fintechs and other sectors, Swid harnesses the strengths of both entities, creating products that deliver maximum value to the end-users. McKinsey’s recent report highlighted the potential of such synergies, noting that embedded finance, a product of such partnerships, generated a staggering $20 billion in the U.S. revenue. The success here is twofold: while banks and partners witness enhanced revenue streams, customers enjoy seamless, integrated banking services.

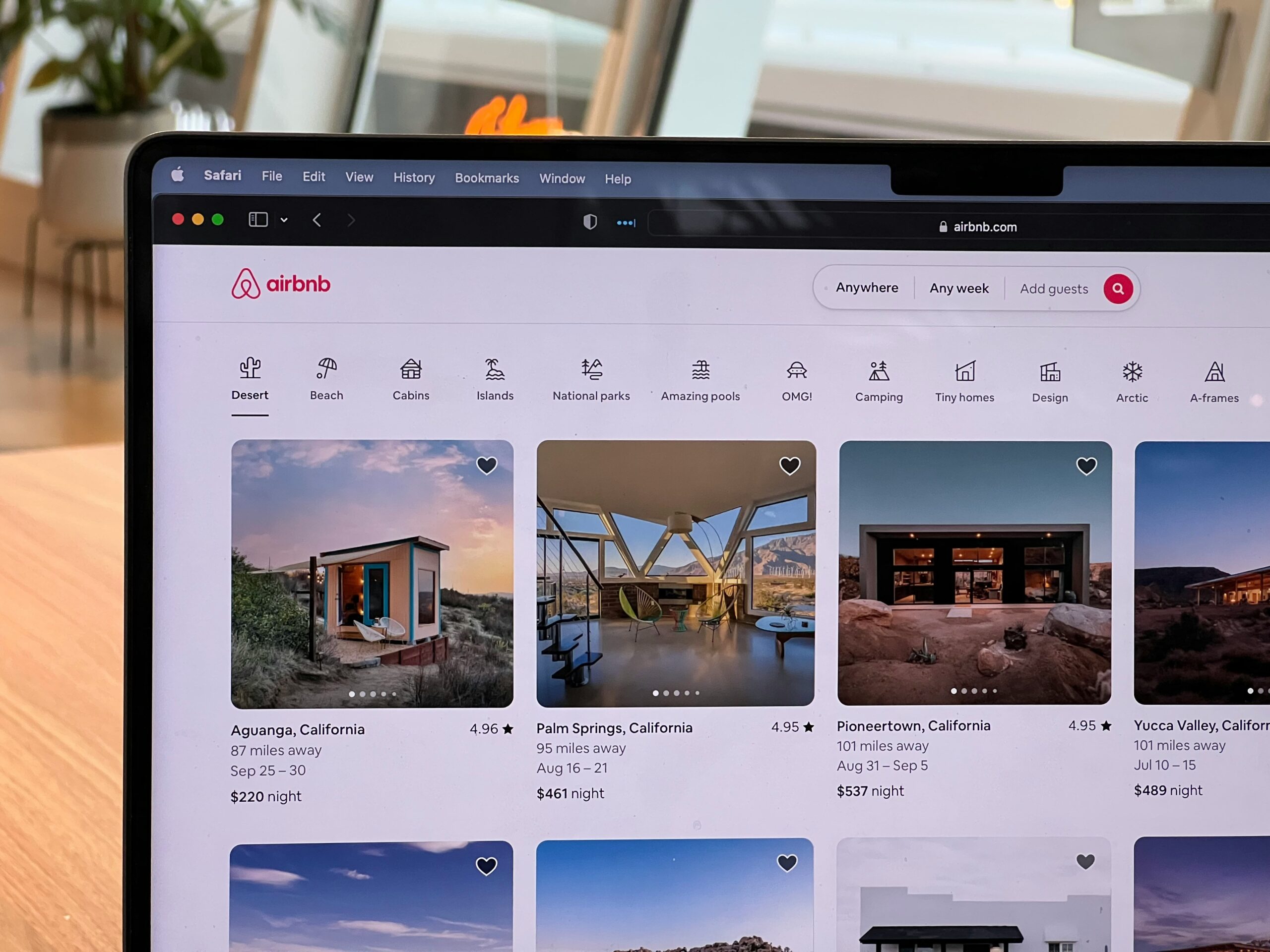

Moreover, Swid is keen on exploring the marketplace model, a concept that resonates well in today’s e-commerce-dominated world. Just as platforms like Amazon bring together sellers and consumers, Swid envisions a similar platform where financial institutions and Non-Financial Companies (NFCs) can offer an array of banking solutions. By providing a holistic ecosystem, they are not only catering to diverse banking needs but also potentially tapping into a revenue opportunity that’s estimated to be worth half a trillion.

Yet, the real game-changer for Swid lies in its adoption of cutting-edge technologies such as Artificial Intelligence (AI) and Machine Learning (ML). Personalization is key in today’s banking world. Customers seek solutions tailored to their unique needs, and that’s where AI and ML come into play. These technologies enable Swid to delve deep into vast amounts of data, refining their offerings and enhancing their efficiency. From fraud detection to credit scoring, the integration of AI and ML within Swid’s BaaS platforms ensures a more streamlined, secure, and effective banking experience for users.

Another noteworthy strategy of Swid is the seamless integration of Application Programming Interfaces (APIs) with BaaS. APIs are essential in allowing banks and their partners to incorporate third-party functionalities efficiently. For NFCs, this translates into an opportunity to deploy BaaS solutions, such as offering payment options to their customers. The interplay between APIs, ML, and AI is the backbone of Swid’s innovative approach to BaaS.

In conclusion, Swid’s journey in pioneering BaaS solutions symbolizes more than just an evolution in banking. It represents a commitment to excellence, innovation, and customer-centricity. As Swid continues its ascent in the fintech realm, its innovative BaaS strategies are set to redefine the financial landscape, offering a blueprint for others to emulate.

Written in partnership with Tom White.