Image credit: Unsplash

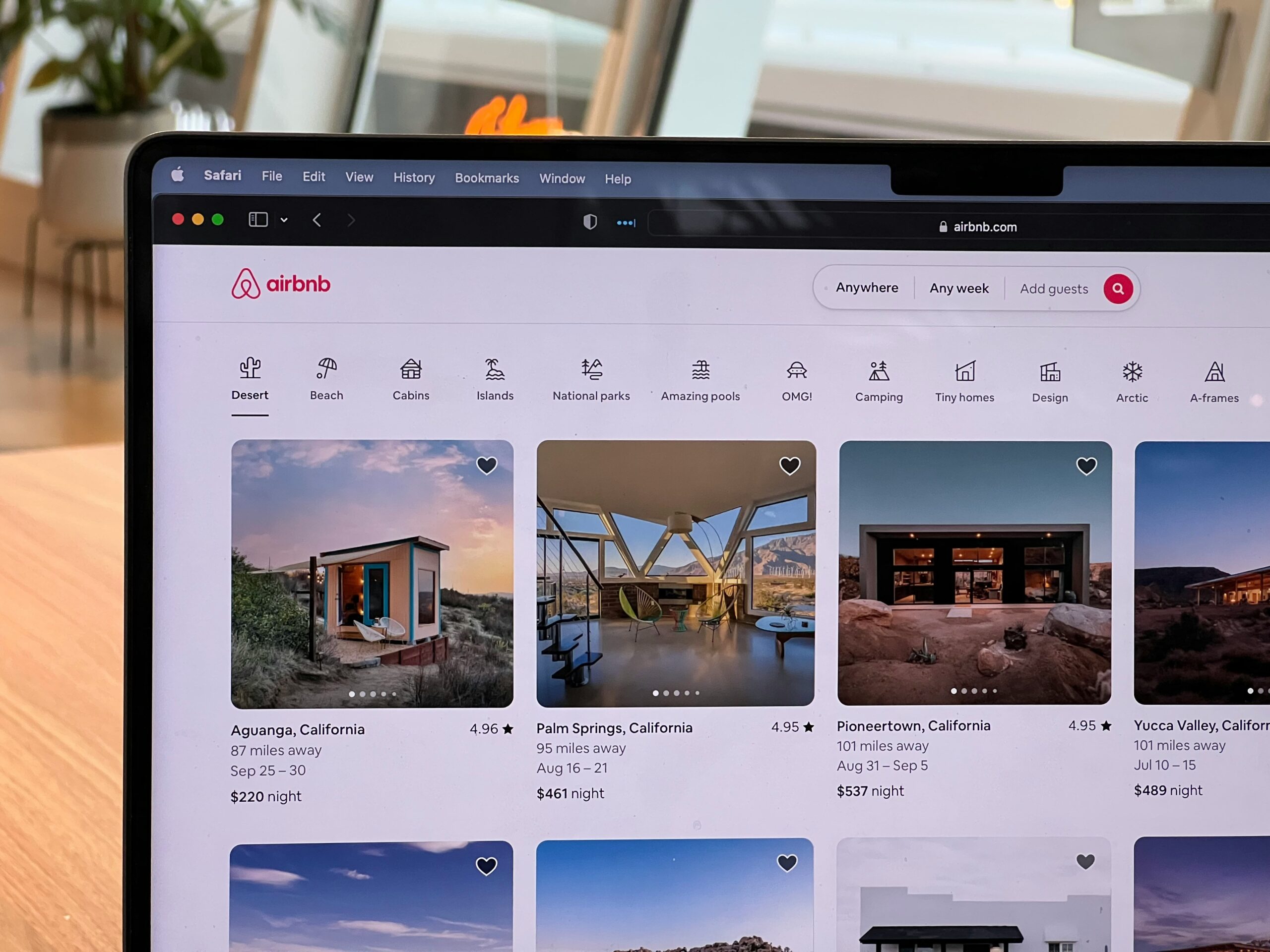

UK Prime Minister Rishi Sunak has selected Hampton Court Palace, a notable 16th-century historical landmark, to host a crucial Foreign Direct Investment (FDI) business summit. This choice signals the UK’s intent to reconnect with its rich historical roots while forging a path forward in the global economic arena.

The palace, a jewel in the crown of British history, offers more than just a grand setting for this high-profile event. Famous for its intricate maze, the palace is a testament to the United Kingdom’s enduring legacy as a center of power and influence. Hosting the summit in such a venue is a statement of intent from Sunak’s government, symbolizing the UK’s aspiration to reconnect with its past economic strengths while forging a path forward in the post-Brexit era.

As Reuters reported on November 23, this summit is poised to play a pivotal role in reshaping Britain’s FDI strategy. With the UK striving to reclaim its position as Europe’s top FDI destination, currently held by France, Prime Minister Sunak faces the challenge of reassuring global investors. The objective is clear: to demonstrate a stable and forward-looking policy environment in the post-Brexit era. Moreover, the summit comes when global FDI flows are recovering from the downturn caused by the COVID-19 pandemic.

The backdrop of Hampton Court Palace is especially poignant given the tumultuous economic landscape following the 2016 Brexit vote. The UK has seen a rapid succession of five prime ministers and frequent changes in key ministerial positions, contributing to a perception of political instability. This has inevitably impacted investor confidence.

The summit aims to address these challenges head-on. Sunak’s goal is to emulate the success of French President Emanuel Macron, who secured 13 billion euros of investment commitments at a similar event in Versailles Palace. To achieve this, Sunak will have to convincingly address concerns over policy consistency, especially in areas such as corporation tax, environmental commitments, infrastructure projects, and renewable energy.

The sentiments of investors like Jack Paris, head of InfraRed Capital Partners, underscore the urgency of the situation. “The UK has diminished in its ability to attract capital in a variety of sectors,” Paris notes. He highlights the need for cohesive policies that work in tandem with private capital incentives, such as tax deductions and subsidies. Paris’s cautious approach to investing in the UK, especially in sectors like heating and energy efficiency, reflects a broader investor community seeking certainty and direction from the UK government.

In response to these concerns, British Finance Minister Jeremy Hunt recently announced long-term tax incentives aimed at boosting business investment, a key lever for accelerating the slow economy. Additionally, the government has expressed support for foreign firms looking to invest in the UK, recognizing the need for a more streamlined and investor-friendly approach.

As the summit at Hampton Court Palace approaches, it represents more than just a diplomatic gathering. It is a symbolic reaffirmation of the UK’s commitment to its economic legacy and future potential. In the halls of Hampton Court, once a center of royal decision-making, Sunak and his team will endeavor to chart a new course for Britain’s economic engagement with the world, reinforcing its stature as a prime destination for international investment.