Image credit: Unsplash

The real estate market has come to life in the Hamptons just in time for spring, with certain wealthy Long Island enclaves leading the way. According to Bloomberg reports, 116 single-family homes entered the market in February, a 51 percent increase over last year. Meanwhile, buyer contracts have increased by 44 percent.

Tod Bourgard, the chief executive officer for Long Island in the offices of Douglas Elliman Real Estate, reportedly told Bloomberg that “everyone was waiting for something.” He went on to say, “The buyers were waiting to see if prices would come down—and prices not only held steady, they crept up—and homeowners are realizing that we are in a very, very good market for sellers.”

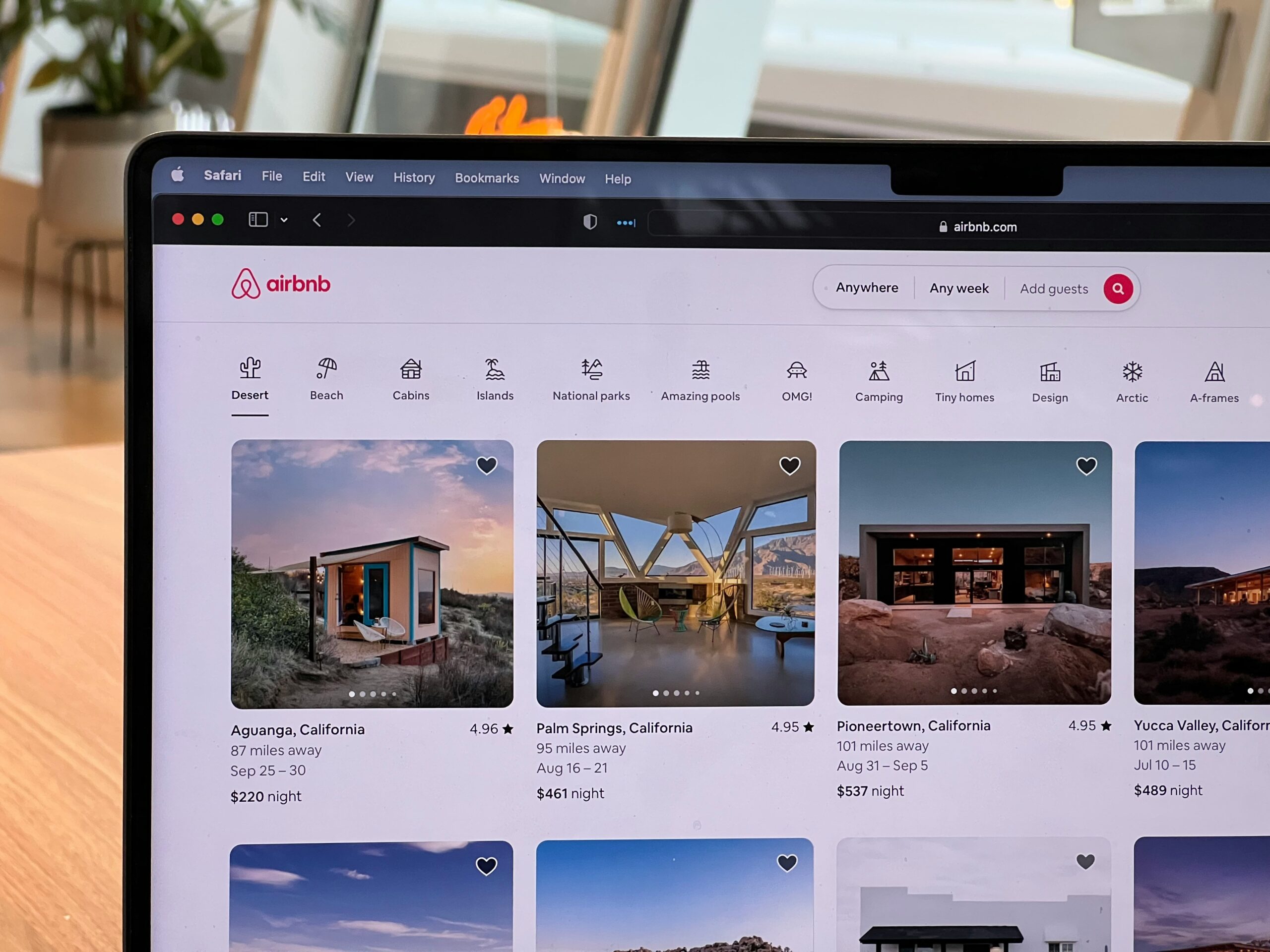

However, inventory remains beneath what it was before the pandemic, which means that the Hamptons real estate market remains competitive. “Inventory is still very scarce,” says Tal Alexander, the co-founder of Official brokerage. “There’s definitely more buyers out there than there are real sellers.” There are numbers to support his point. At the end of 2019, there were around 1,800 single-family properties on the market. At the same time, in 2023, there were less than a thousand homes available. This is an extreme long-term drought in the housing market.

This leads to predictable effects on the prices of properties, which are playing out in real-time in the Hamptons. New listings in the Hamptons with asking prices between $5 million and $10 million increased by 136 percent. This is still at the lower end of the spectrum for the area. On the higher end, only three homes listed at about $20 million went on the market in February. Last year, during the same period, there were four. That might only be a one-home difference, but it is a 25% drop, and at these extreme values, one house counts for a lot.

Pamela Liebman, the CEO of the Corcoran Group, says, “Buyers that were sitting on the sidelines are starting to get nervous that if interest rates do start to come down, there’ll be more competition in the market and prices may even go up further.” She pointed out that more real estate buyers are making all-cash offers, which is a trend that carried over from last year. In 2023, roughly 43% of all luxury home sales in the US were executed with cash payments. This represents an eagerness among buyers or an anxiety that someone else will buy a property before they get the chance.

It could also indicate that buyers are willing to shell out more upfront costs to avoid high mortgage rates, which had also been a trend in the Hamptons. However, mortgage rates have been less aggressive this year, which plays a part in Bloomberg’s expectations of seeing the housing market accelerate in the coming months.

Others in the area mirror this prediction, though some maintain only tempered enthusiasm. Erin Sykes, the chief economist at the Nest Seekers International brokerage, has told the media, “Overall, we expect 2024 to behave more like 2022 than 2023 and feature moderate, sustainable growth.”